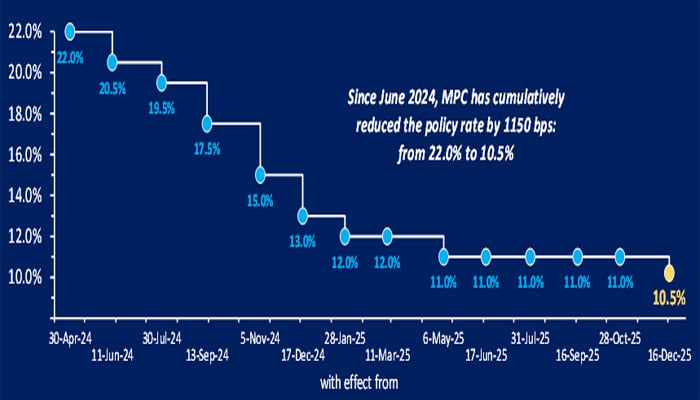

The State Bank of Pakistan (SBP) on Monday reduced the key policy rate by 50 basis points to 10.5% in a surprise move despite food-led inflation pressures and external considerations.

In the last four monetary policy meetings, the central bank had observed the status quo. The latest reduction takes the total easing since rates peaked at 22% to 1,150 basis points.

Analysts had largely expected that the central bank to maintain status quo as headline inflation has been gradually increasing, rising from 4.1% in July to 6.1% in November, largely due to disruptions in the food supply caused by floods.

An analyst at Arib Habib Limited (AHL) stated the SBP was likely to keep rates steady at the December meeting to maintain stability while adopting a cautious stance, as the base effect that had kept headline inflation low is now fading.

“The slight widening of the current account deficit and the early stage of domestic economic recovery further support a prudent, wait-and-see approach from the central bank,” it added.

According to the AHL report, inflationary pressures may boost in the near term, with seasonal factors such as Ramazan and Eid in the second half of FY26 potentially pushing monthly inflation higher.

“There remains a possibility that inflation temporarily tests double-digit levels if monthly momentum picks up; however, the full-year FY26 average is still likely to remain within the SBP’s medium-term target range of 5-7%,” it said.

Meanwhile, on the external front, conditions are stable but need closed monitoring, added the report, alerting that rising import demand and changing trade dynamics could create additional pressure ahead.