The head of Pakistan’s newly established virtual assets regulator has drawn criticism after publicly suggesting that people could learn how to buy Bitcoin through online videos, despite the country lacking a fully regulated cryptocurrency market.

Pakistan Virtual Assets Regulatory Authority Chairman Bilal bin Saqib made the comments during a television interview, where he clarified that he was not offering financial advice but noted that many people globally had learned to purchase digital assets through online tutorials.

These statements attracted media attention on social media platforms, with people wondering why this was necessary, coming from the top virtual assets regulator in the country.

The opposition also raised issues regarding investor protection, given the fact that many Pakistanis are using cryptocurrencies on peer-to-peer platforms that are not regulated to a large extent.

Saqib highlighted in the interview that Pakistan needs to think out of the box and embrace the future technologies that are emerging. Digital assets, AI, robotics, drones, and the concept of quantum computing would play an important part in the future economies and capacities of states, and Pakistan needs to keep up with the trend.

At the start of this month, ministry of finance entered into a memorandum of understanding with Binance Investments Co., an international digital assets company, to explore possible uses of blockchain technology in Pakistan.

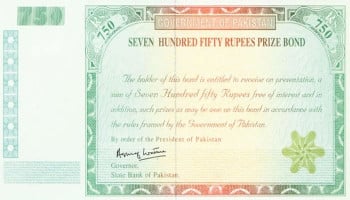

The deal, signed between the Finance Minister of Pakistan Muhammad Aurangzeb and Binance CEO Richard Teng, with the assistance of Pakistan Crypto Council adviser Changpeng Zhao, aims at evaluating the tokenisation and digital distribution of real-world and sovereign assets.

As per reports, the plan could also cover government bonds, treasury bills, commodity reserves, and other government-owned assets pending regulatory approval. In later stages, assets up to a value of $2 billion would also be taken into account.