The Federal Board of Revenue (FBR) has officially clarified that text messages sent to income tax filers about their bank accounts and property transactions do not breach their financial privacy.

The FBR, in a brief submitted to the Senate Standing Committee on Finance, stated that the purpose of the recent text messages sent to filers was to improve taxpayer awareness and compliance through behaviourally informed nudges.

Moreover, the information sent pertains solely to the taxpayer's own financial profile, which is share exclusively with the individual to whom the data belongs. According to the tax collection body, no third party is ever involved in the transmission of such messages, and all communications are made through secure official channels.

FBR, under the Income Tax Ordinance, 2001, is legally allowed to get third-party data from different institutions for the purpose of broadening the tax base and improving compliance, particularly:

- Section 165A of the Ordinance authorises every banking company to furnish prescribed information to the Board, including particulars of deposits, withdrawals, and payments above defined thresholds.

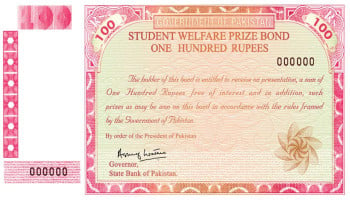

- Section 175A provides for real-time access to information and databases from designated agencies such as the National Database and Registration Authority (NADRA), Federal Investigation Agency (FIA, State Bank of Pakistan (SBP), provincial land authorities, electricity and gas utilities, and others, subject to confidentiality under Section 216, to be used strictly for tax purposes.

The FBR noted that all the data are helf within authority's secure systems, which are used for the purpose of risk-based analysis and taxpayer facilitation, in strict conformity with the provisions of the law and the rules of data protection.