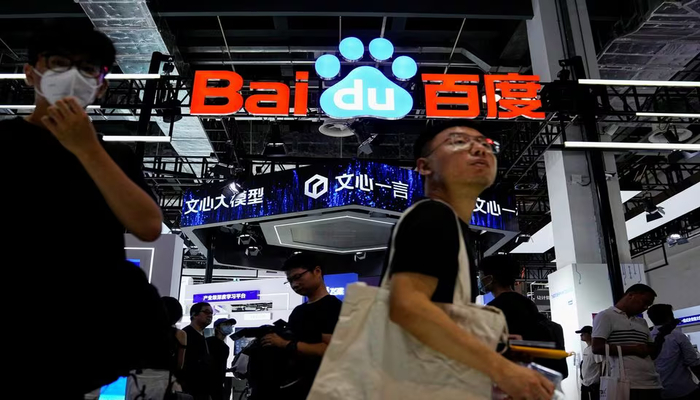

Baidu, the Chinese technology company, faced a setback in its efforts to expand its live-streaming business and enhance revenue diversification in China.

The planned $3.6 billion acquisition, aimed at strengthening Baidu's position, collapsed as an affiliate company terminated its 2020 agreement with Nasdaq-listed Joyy (YY), the parent company of the well-known live streaming platform YY Live.

The leading search engine in China, Baidu, declared in November 2020 that it had reached a deal to acquire YY Live to diversify its income streams away from advertising and that it anticipated the transaction to finish in the first half of 2021, CNN reported.

Read more: Goldman Sachs' chief economist anticipates three consecutive interest rate cuts

Baidu revealed that the deal broke due to certain conditions that failed to be met by the December 31 deadline, as mentioned in a filing with the Hong Kong Stock Exchange. These conditions included the failure to secure the “necessary regulatory approvals.”

In an official statement, Joyy stated that it had been notified by Baidu's subsidiary that it was entitled to "effectively cancel the transaction."

The live-streaming firm, owning multiple platforms under its belt and 277 million monthly active users worldwide, announced that it was taking legal action.

Similar to other live streaming services in China, YY Live generates revenue by selling virtual gifts that users purchase for performers.

Joyy, the parent company, recorded net revenues of $567.1 million in the third quarter of 2023, a decrease from $586.7 million in the same period of the previous year. Revenues from live streaming experienced a nearly 9% decline, reaching $495.8 million.