For abroad-living Pakistanis, sending money home safely to families can be a hassle, considering a plethora of available options. However, a game-changing money transfer service has emerged in partnership with the United Bank Limited (UBL) to address this. RightCard Payment Service Limited, operated as LemFi, has received approval from the State Bank of Pakistan (SBP).

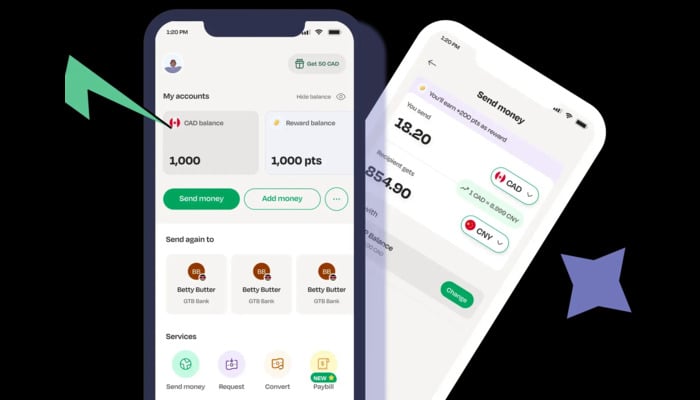

Making it effortless for overseas Pakistanis to transfer their hard-earned money back home with safety, the collaboration means that LemFi can provide secure, affordable, and efficient money transfer services for millions of Pakistanis living in the UK, Canada, the US, and Europe.

Pakistan is one of the biggest remittance-receiving nations from the aforementioned countries, with an estimated inflow of over US$33 billion in personal remittances expected in 2024.

Muhammad Daiyaan Alam, the head of LemFi’s South Asia Expansion & Growth, expressed gratitude for the SBP's approval, stating: “Pakistan is a vital remittance corridor for us, and we are committed to making money transfers reliable and cost-effective for Pakistani families worldwide.”

The SBP’s approval is a nod to its strategy to enhance financial inclusion and facilitate cross-border transactions. As a prerequisite for this approval, LemFi underwent a comprehensive review to ensure compliance with regulatory standards, focusing on technical capabilities, financial stability, and consumer protection.

LemFi’s Head of Global Expansion Philip Daniel maintained that their collaboration with UBL is to create a more inclusive financial future for Pakistanis.

Some of the most outstanding perks of the LemFi-UBL partnership include regulatory compliance, trust and reliability, and competitive offerings such as low fees and attractive exchange rates.