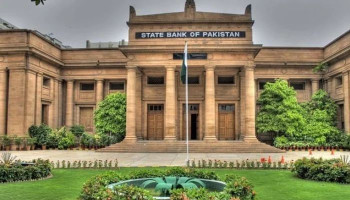

Pakistan has been undergoing a massive shift towards a cashless economy, which is evident in the State Bank of Pakistan's (SBP) instant digital payment system, Raast, surpassing Rs20 trillion in digital transactions.

Since its inception, Raast has now processed over 892 million transactions worth Rs20tn, which indicates a notable achievement in bringing about the country’s digital transformation.

To further improve digital payments, the SBP recently launched the “Go Cashless” campaign during Pakistan Financial Literacy Week 2025 at a popular shopping mall in Clifton, Karachi. It was headed by SBP Deputy Governor Saleem Ullah alongside 12 well-established financial institutions.

The primary objective of the Pakistan Financial Literacy Week 2025 is said to be about educating both consumers and merchants on the benefits of digital transactions, which include quicker, safer, and more convenient transactions than cash.

The initiative was part of a bigger mission to make Pakistan a financially inclusive and digitally empowered economy, Saleem Ullah stated, according to Phone World.

Raast handled 795.7 million transactions amounting to Rs6.4tn in Q1 2025 alone.

It was also learned that mobile and internet banking also marked an uptick of 62%, suggesting increasing public trust in digital money transfers. As of FY24, digital transactions surged by 35%, with their value reaching Rs547tn.